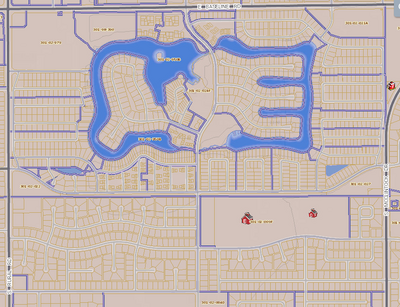

maricopa county tax lien map

Vehicle sales tax in memphis tn. View various years of aerial imagery for Maricopa County dating back to 1930.

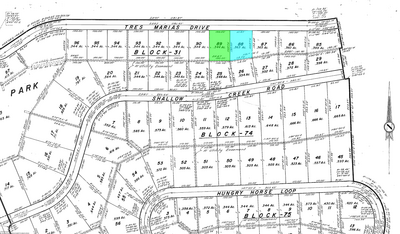

Land Brokers Phoenix Arizona Land For Sale

Maricopa county tax lien map.

. When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St. Maricopa County AZ currently has 2496 tax liens available as of December 25.

Maricopa County Treasurers Home Page. Maricopa County Tax Lien Map. Flood Control District Maps Services.

Enter the address or street intersection to search for and then click on Go. Maricopa County Assessors Office Maricopa County GIO. The advertisement appears in the Arizona Business Gazette about three weeks before the auction.

Assessor - parcel information and mapping. Maricopa County GIS Maps and Services - interactive maps from a variety of county GIS sources. The maximum credit available for the increased excise tax Form 140ET is 100 per household.

Parcels whose taxes are subject to sale will be advertised in January in a Maricopa County newspaper of general circulation. Maricopa county az currently has 20808 tax liens available as of february 4. Click here to download the available State CP list.

Send a completed order form with your payment of 2500 personal or business check cashiers check or money order to. Ad Find Out If a Property Has Any Registered Liens Before Making an Offer. View various years of aerial imagery for maricopa county.

Visit Arizona tax sale to register and participate. Maricopa county tax lien map. The map allows citizens to select a location within Maricopa County and submit a comment.

If you do not have access to a computer the Treasurers Office will provide public access computers by appointment at designated locations. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. The tax lien sale provides for the payment of delinquent property taxes by an investor.

The place date and time of the tax lien sale. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the Maricopa County Arizona tax lien certificate Sec. How does someone acquire a tax lien.

Bidding is online only and will begin when the list is published and close on february 5 2019. In the Arizona Business Gazette Copies of the newspaper are usually available for purchase at the Treasurers Office. Preview and bidding will begin on January 26 2021.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. How does a tax lien sale work.

Maricopa county superior courts modified operations website the arizona tax department was established in september 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. Maricopa county tax lien map. Maricopa County Tax Lien Research Arizona Tax Liens.

Interested in a tax lien in Maricopa County AZ. Please read the disclaimer before deciding to bid and see our lien FAQ Page and Lien History Page. Additionally users can view existing approved comments and reply to them.

9831 S 51ST ST SUITE D134. Maricopa County AZ currently has 22642 tax liens available as of February 14. The tax lien sale will be held on february 9 2021.

Has been developed to provide easy access to the information and maps associated with the zoning annexations floodplain and other delineations within Maricopa County. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. The address on file for this spur is 525 E Hayward Phoenix AZ 5020 in Maricopa County.

The Treasurers tax lien auction web site will be available 1252022 for both research and registration. County maps for research may be found by visiting the Maricopa County. Register for 1 to See All Listings Online.

Maricopa County Assessors Office. The sale takes place. Buy Tax Delinquent Homes and Save Up to 50.

On a CD from the Research Material Buying Guide available at the beginning of January. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars. Liens are publicly recorded in the county where the property is located.

To be eligible to bid you must complete the following steps on the auction web site. The Tax Lien Sale provides for the payment of delinquent property taxes by an. Maricopa County Assessors Office The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with a full cash value of more than 717 billion in 2022 Services and Products e-Notices The Maricopa County Assessors Office now offers electronic notices eNotices for your Notice of Valuation.

The Tax Lien Sale will be held on February 9 2021. An excise tax is a tax levied on certain goods by the state or federal government such as fuel cigarettes cellphones and alcoholic beverages. As of november 28 pinal county az shows 8095 tax liens.

Perform a Complete Property Record Scan in Less than Two Minutes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales.

In property lines for a map to log in maricopa county tax. View which parcels have overdue property taxes and unsold liens. Current Mailing Name Address.

Tax Lien Web The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. 27 rows Liens Sold Outstanding Sold Liens Redeemed Sold Liens State Liens 1 Parcels may.

As of October 2 Maricopa County AZ shows 1469 tax liens.

Nice Chandler Metro Map Zip Code Map Metro Map Map

Displaced In America Housing Loss In Maricopa County Arizona

New Supervisor Districts Ok D Maricopa Whole Coolidge Split News Pinalcentral Com

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Gosar To Exit Pinal District Run In New District 9 News Pinalcentral Com

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Maricopa County Treasurer S Office John M Allen Treasurer

2017 Maricopa County Parcel Data Asu Library

Land Brokers Phoenix Arizona Land For Sale

City Limits Maricopa County Az

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Maricopa County Island What Is It Arizona Homes Horse Property

2017 Maricopa County Parcel Data Asu Library

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas